[ad_1]

Bitcoin prolonged its corrective section, buying and selling round $87,575, with the BTC to PKR fee hovering close to ₨24.3 million, as on-chain information confirmed a contemporary wave of promoting by long-term holders. The transfer highlights shifting market dynamics after months of elevated costs.

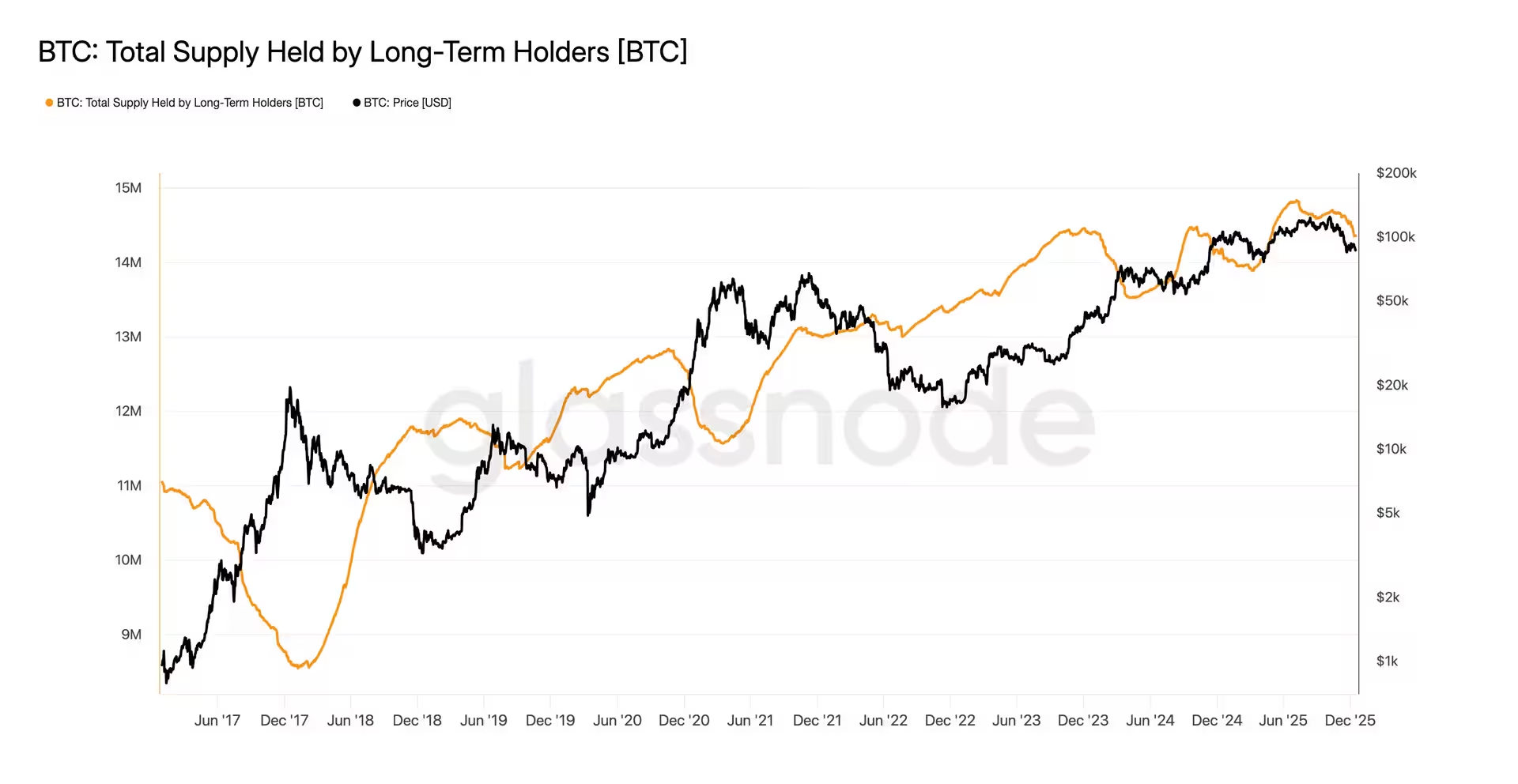

In line with Glassnode information, Bitcoin’s long-term holder (LTH) provide has dropped to about 14.34 million BTC, the bottom stage in almost eight months and a stage final seen in Could. Lengthy-term holders are outlined as traders who’ve held Bitcoin for no less than 155 days, putting the present cohort cutoff round mid-July. The decline in provide coincides with Bitcoin falling nearly 40 % from its October all-time excessive.

Analysts say that is the third wave of LTH distribution within the present cycle. The primary wave adopted the launch of U.S. spot Bitcoin ETFs, when costs surged from round $25,000 to almost $73,000. A second wave emerged as Bitcoin rallied towards the $100,000 mark after optimism linked to President Donald Trump’s election victory. The market is now witnessing a 3rd spherical of promoting, at the same time as costs have remained elevated for a lot of the 12 months.

Blockchain analysts word tha,t in contrast to earlier bull markets, which generally noticed a single blow-off distribution section, this cycle is marked by a number of promote waves that the market has to date absorbed. Commenting on the development, an on-chain analyst mentioned,

“Lengthy-term holder spending this cycle is in contrast to something seen in latest historical past, but demand continues to soak up the stress.”

Outlook for Bitcoin

LTH distribution stays one of many largest sources of sell-side stress in Bitcoin and has performed a key position within the ongoing correction. Market members at the moment are watching whether or not costs stabilize at present ranges or face additional draw back earlier than renewed accumulation begins.

[ad_2]